Continue subtracting the depreciation from the balance and multiplying by 20% to get each year's depreciation.

Multiply that amount by 20% to get the second year's depreciation deduction. This is the first year's depreciation deduction.įor the second year depreciation, subtract year one's depreciation from the asset's original depreciation basis. Then multiply the one-year depreciation value by 2. First find the yearly straight line depreciation value as explained above. Straight line depreciation gives you the same depreciation expense for each year of asset use.ĭouble declining balance is an accelerated depreciation method that front-loads depreciation of an asset. Divide the result, which is the depreciation basis, by the number of years of useful life. Then subtract the salvage value from the initial cost of the asset.

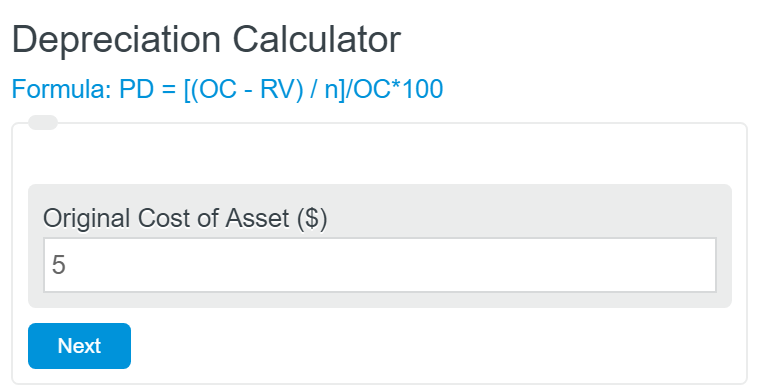

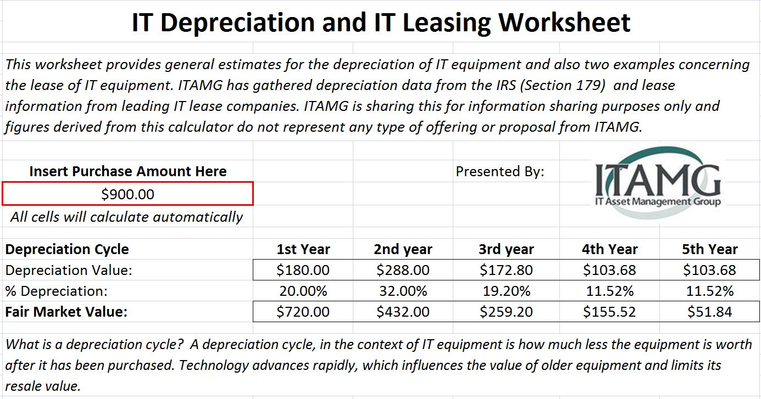

First estimate the asset's salvage value which is the residual value of an asset at the end of its useful life. This is a simple linear form of depreciation. Methods of Depreciation Explained Straight Line Depreciation Original cost of the asset is $10,000, salvage value is $1400, and useful life is 10 years. This graph compares asset value depreciation given straight line, sum of years' digits, and double declining balance depreciation methods. The number of units produced in the depreciation period In the Units of Production Depreciation method, the expected number of units the asset will produce or how long it will last (for example, miles, widgets, hours, etc.) The math factor used to calculate the depreciation rate per year A factor of 2 indicates a rate of 200% depreciation per year and is commonly called double declining depreciation The way depreciation is calculated depreciation conventions include full-month, mid-month, mid-quarter, or half-year methods The most common convention is the full-month depreciation convention The month and year the asset began being used for its intended purposeĮnter a four digit year for calendar years or enter "1" to list years 1 through useful life in the depreciation schedule The expected number of years of asset use The value of the asset at the end of its useful life residual value, scrap value The initial cost of your asset or the capital expended to prepare an asset for its intended use CalculatorSoup offers many depreciation calculators with alternative methods of depreciation. These depreciation methods are explained in detail below. The most common methods of calculating depreciation are: You will probably want to find a balance between the yearly depreciation expense and generated revenue or long-term cost of maintaining the asset. Which method you use depends on the cost of the asset, its length of useful life, and your business concerns. There are multiple methods for calculating a depreciation schedule. The cost of an asset and its expected lifetime are factors that businesses use to find the best way to deduct depreciation expenses against revenues. When writing income statements businesses can also enter asset depreciations as an expense or cost of doing business. Rather than fully deduct the cost of an asset in the same year it was purchased, businesses can deduct part of the cost of the asset each year according to a calculated depreciation schedule. The salvage value is the remaining value of an asset once it reaches the end of its useful life.īusinesses often use depreciation to offset the initial cost of acquiring an asset for tax purposes. How much an asset can depreciate over time is limited by its estimated final salvage value. It is an accounting method used by businesses to spread the initial cost of an asset over its years of useful life. What is Depreciation?ĭepreciation is a way to quantify how the value of an asset decreases over time. Calculate depreciation of an asset's value over time and create printable depreciation schedules.

0 kommentar(er)

0 kommentar(er)